The Facts About Baron Tax & Accounting Uncovered

The Facts About Baron Tax & Accounting Uncovered

Blog Article

Baron Tax & Accounting - Questions

Table of ContentsLittle Known Questions About Baron Tax & Accounting.3 Easy Facts About Baron Tax & Accounting ShownThe 7-Minute Rule for Baron Tax & AccountingBaron Tax & Accounting - TruthsThe Basic Principles Of Baron Tax & Accounting

And also, bookkeepers are expected to have a suitable understanding of maths and have some experience in an administrative duty. To become an accountant, you must contend the very least a bachelor's degree or, for a greater degree of authority and competence, you can become a public accounting professional. Accountants should additionally fulfill the rigorous demands of the accounting code of technique.

The minimal qualification for the certified public accountant and ICAA is a bachelor's level in accountancy. This is a starting point for more research. This ensures Australian company owner obtain the very best possible economic guidance and management feasible. Throughout this blog site, we have actually highlighted the big differences in between bookkeepers and accountants, from training, to functions within your business.

Get This Report on Baron Tax & Accounting

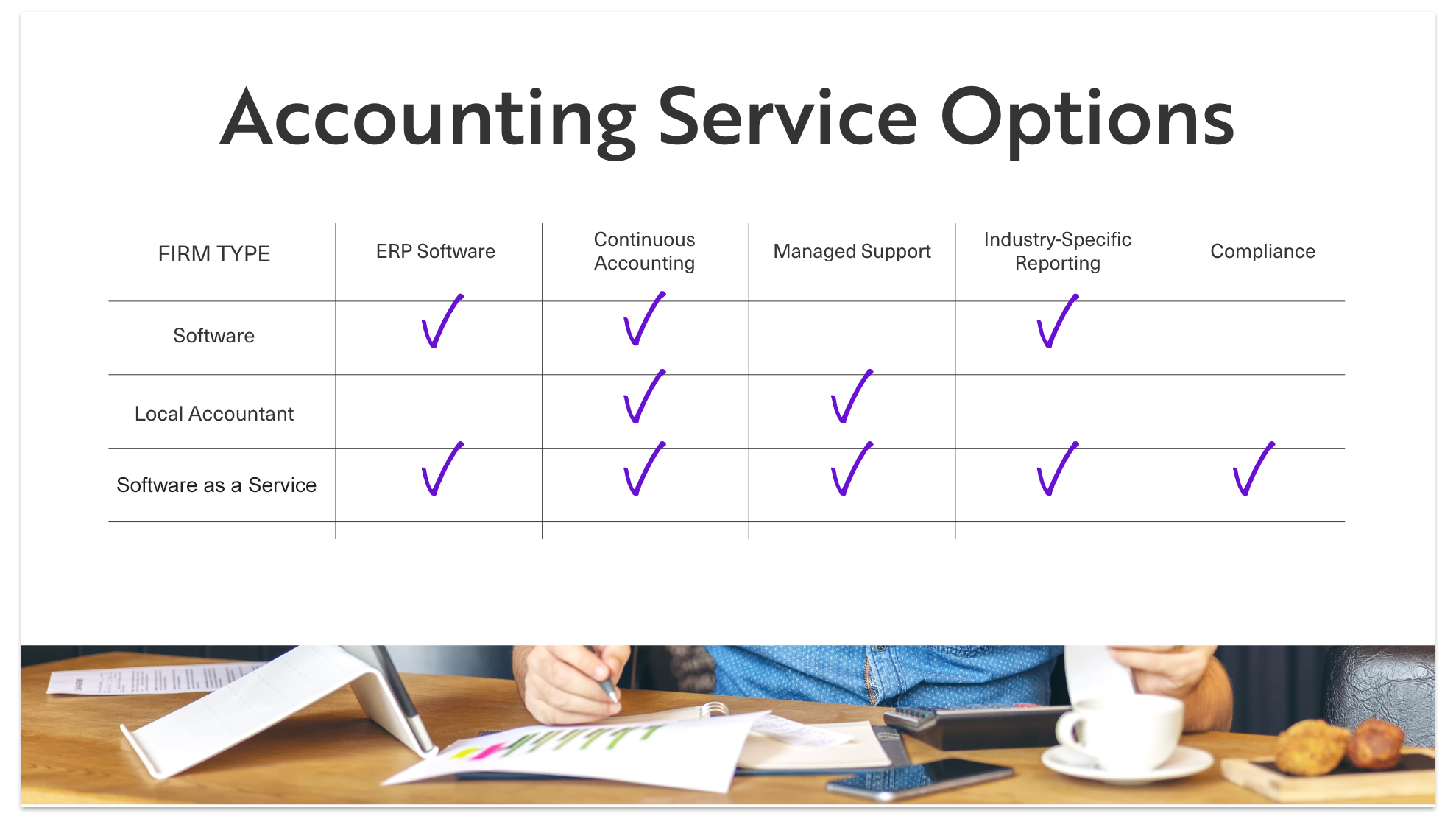

The services they give can take full advantage of revenues and support your funds. Businesses and people ought to take into consideration accountants an essential element of financial preparation. No accounting company provides every service, so ensure your consultants are best fit to your specific needs.

(https://www.openstreetmap.org/user/baronaccounting)

Accountants exist to compute and update the collection quantity of cash every worker obtains consistently. Keep in mind that holidays and illness affect pay-roll, so it's an aspect of the company that you must regularly upgrade. Retired life is likewise a significant component of pay-roll administration, specifically given that not every staff member will certainly wish to be enrolled or be eligible for your business's retired life matching.

Our Baron Tax & Accounting Ideas

Some lenders and capitalists call for definitive, tactical decisions in between business and investors complying with the conference. Accounting professionals can also be existing right here to help in the decision-making process. Preparation entails providing the income, cash money circulation, and equity statements to assess your current monetary standing and problem. It's very easy to see just how complex accountancy browse this site can be by the variety of skills and tasks needed in the role.

Little businesses typically face one-of-a-kind economic challenges, which is where accounting professionals can supply indispensable support. Accountants use a range of services that assist services stay on top of their finances and make educated decisions. digital tax agent for individuals.

Accountants make sure that staff members are paid accurately and on time. They calculate payroll tax obligations, take care of withholdings, and ensure compliance with governmental policies. Processing paychecks Managing tax obligation filings and repayments Tracking employee advantages and reductions Preparing pay-roll reports Appropriate payroll monitoring protects against concerns such as late payments, inaccurate tax obligation filings, and non-compliance with labor legislations.

Getting My Baron Tax & Accounting To Work

This step decreases the danger of errors and possible fines. Local business owners can depend on their accounting professionals to manage intricate tax obligation codes and guidelines, making the declaring process smoother and more effective. Tax obligation planning is an additional necessary service supplied by accountants. Efficient tax obligation planning entails strategizing throughout the year to lessen tax obligation obligations.

Accounting professionals aid tiny companies in determining the worth of the business. Approaches like,, and are made use of. Exact appraisal aids with offering the service, safeguarding fundings, or bring in financiers.

Overview company proprietors on finest practices. Audit assistance assists businesses go via audits smoothly and successfully. It minimizes anxiety and errors, making sure that organizations satisfy all necessary laws.

By establishing sensible financial targets, companies can allocate resources successfully. Accountants overview in the implementation of these approaches to ensure they straighten with the company's vision. They regularly evaluate strategies to adapt to altering market problems or business development. Risk management includes recognizing, examining, and mitigating risks that might influence an organization.

What Does Baron Tax & Accounting Mean?

They help in establishing interior controls to stop fraudulence and mistakes. Furthermore, accountants recommend on conformity with lawful and regulatory needs. They guarantee that companies follow tax obligation regulations and industry regulations to avoid penalties. Accounting professionals additionally suggest insurance plan that offer protection versus potential threats, making certain the organization is guarded versus unexpected events.

These devices assist tiny companies maintain exact records and streamline procedures. It helps with invoicing, pay-roll, and tax prep work. It offers numerous features at no price and is appropriate for startups and tiny organizations.

Report this page